Group Health Insurance: Common Misconceptions and Facts

Understanding group health insurance: facts vs. Fiction

Group health insurance serve as a cornerstone of employee benefits packages across America. As healthcare costs continue to rise, both employers and employees need accurate information about how these plans work. Nonetheless, misconceptions abound in this complex field. This article examines common statements about group health insurance and identifies which ones are factual and which contain inaccuracies.

The basics of group health insurance

Group health insurance provide coverage to members of a group, typically employees of a company or members of an organization. Before diving into specific statements, it’s important to understand the fundamental principles that govern these plans.

These insurance policies are contracts between an insurance company and an entity (commonly an employer )that provide health coverage to individuals within the group. The employer typically shsharesremium costs with employees, create a system that benefit both parties through share risk and purchasing power.

True statement: group health insurance oftentimes cost less than individual plans

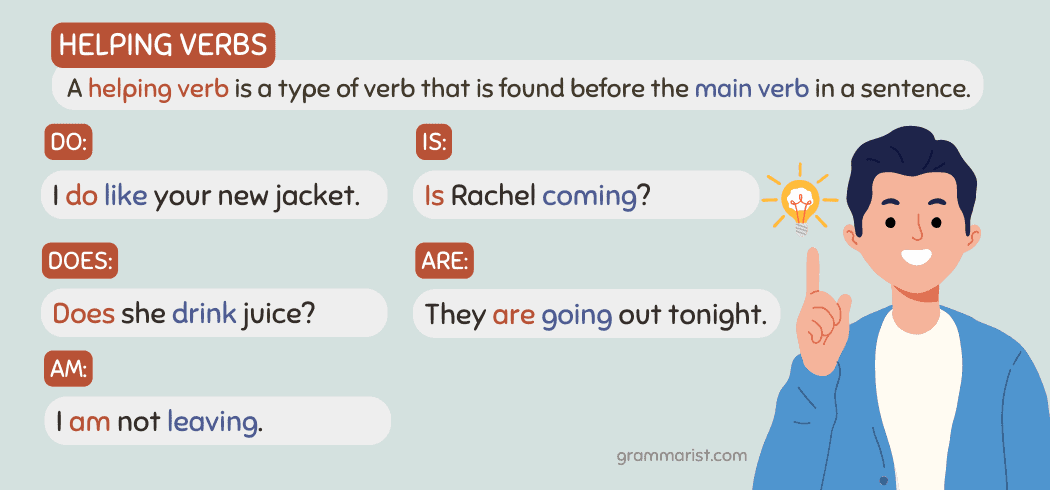

One accurate statement about group health insurance is that premiums are broadly lower than comparable individual health insurance plans. This cost advantage stem from several factors:

- Risk is spread across a larger pool of individuals

- Administrative costs are distributed among more people

- Insurance companies can negotiate better rates when cover larger groups

- Employers oftentimes contribute to premium payments, reduce employee costs

This cost efficiency make group plans attractive to both employers and employees, create a win-win situation that encourage participation.

True statement: employer contributions are normally tax-deductible

Another factual statement is that employer contributions to group health insurance premiums are typically tax-deductible business expenses. Additionally, the portion of premiums pay by employees can oft be make with pre-tax dollars through section 125 plans (cafeteria plans ) reduce taxable income for employees.

This tax advantage create significant financial benefits beyond the direct health coverage, make group insurance an important part of total compensation packages.

True statement: group plans must cover essential health benefits under ACA

Under the Affordable Care Act (aACA) group health insurance plans must cover essential health benefits for companies with 50 or more fufull-timequivalent employees. These benefits include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive and wellness services

- Pediatric services, include oral and vision care

This requirement ensures comprehensive coverage for employees in larger organizations, though smaller employers may have some flexibility depend on plan type.

True statement: employers can not deny coverage base on health status

Group health insurance plans can not deny coverage to eligible employees base on health status, medical conditions, claims history, genetic information, disability, or other health relate factors. This protection stem from both the health insurance portability and accountability act (hHIPAA)and the acACA

This non-discrimination requirement ensure that all eligible employees have access to health coverage disregardless of their medical history or current health status.

Source: turtlemint.com

False statement: all employers are lawfully requiredofferingr group health insurance

Here we encounter our first false statement. Contrary to popular belief, not all employers are lawfully requiredofferingr group health insurance to their employees. TheACAa’s employer mandate exclusively apply to applicable large employers( ales) with 50 or more ffull-timeequivalent employees.

Smaller businesses with fewer than 50 full-time equivalent employees are not subject to penalties for not offer health insurance coverage. Many small businesses do offer health benefits to remain competitive in hiring and retention, but this is a business decision kinda than a legal requirement.

True statement: group health insurance offer special enrollment periods

Group health insurance plans provide special enrollment periods when employees can enroll outside the normal open enrollment period due to qualify life events such as:

- Marriage or divorce

- Birth or adoption of a child

- Loss of other health coverage

- Move to a new location

- Changes in household income that affect eligibility for subsidies

These special enrollment periods typically last for 30 60 days follow the qualifying event, give employees flexibility to adjust coverage when life circumstances change.

True statement: cobra allow to continue coverage after employment ends

The consolidated omnibus budget reconciliation act (cobra )allow employees to maintain their group health insurance coverage after employment ends or hours are rereducedelow the plan’s eligibility requirements. This continuation coverage is available for a limited period ((ypically 18 months ))nd require the former employee to pay the full premium plus a small administrative fee.

Cobra provide an important safety net during job transitions, though the cost can be well higher than what employees pay while actively employ since they must forthwith cover the employer’s portion equally advantageously.

True statement: group health insurance must cover dependents to age 26

Under the ACA, group health plans that offer dependent coverage must make coverage available for children until they turn 26 years old. This requirement applies disregarding of whether the child:

- Live with the parent

- Is financially dependent on the parent

- Is a student

- Is marry

- Is eligible for other coverage

This provision has help millions of young adults maintain health insurance coverage during the transition to financial independence and career establishment.

False statement: group health insurance premiums are invariably base on the health status of group members

Another false statement is that group health insurance premiums are invariably base on the health status of individual group members. In reality, the ACA prohibit health insurance companies from charge higher premiums base on health status, medical history, or gender for small group plans (mostly those with 50 or fewer employees )

For these small group plans, premiums can exclusively vary base on:

- Age (with limitations on how much rates can vary )

- Geographic location

- Family size

- Tobacco use

Large group plans (commonly those with more than 50 employees )have different rating rules, but fififtyhese plans have significant restrictions on how health status can affect premiums.

True statement: self fund plans have different regulatory requirements

Self fund (or self insure )group health plans, where the employer asassumeshe financial risk for provide health benefits, are subject to different regulatory requirements than full insure plans. These plans are mainly rregulatedunder the employee retirement income security act (eErica)preferably than state insurance laws.

Self fund plans must notwithstanding comply with many federal requirements, include those in the ACA, but have greater flexibility in plan design and are exempt from state insurance mandates and premium taxes.

True statement: group health insurance can be offered tpart-timeme employees

Employers can offer group health insurance to part-time employees, though they’re not requireddoingo hence under theACAa’s employer mandate. TheACAa define full time as 30 hours per week or more, but employers have flexibility to offer coverage to employees work fewer hours.

Many employers extend coverage to part-time workers as a competitive benefit, especially in tight labor markets or industries where part-time work is common.

False statement: all group health insurance plans must cover the same benefits

It’s incorrect to state that all group health insurance plans must cover identical benefits. While the ACA establish essential health benefits that must be cover by non grandfathered small group plans, there remain significant variation in:

- Coverage levels and cost sharing requirements

- Provider networks

- Prescription drug formularies

- Additional benefits beyond the essential requirements

- Plan types (hHMO pPPO hDHP etc. ))

Large group plans have still more flexibility in benefit design, though they must ease meet minimum value standards under the ACA.

True statement: wait periods can not exceed 90 days

Under the ACA, group health plans can not impose waiting periods that exceed 90 calendar days before coverage become effective for eligible employees. This limitation ensure that new employees gain access to health benefits within a reasonable timeframe after start employment.

Employers can implement shorter waiting periods or eliminate them solely, but can not extend them beyond the 90-day maximum.

Common misconceptions about group health insurance

False statement: employers can reimburse employees for individual health insurance premiums without penalty

An especially persistent misconception is that employers can merely reimburse employees for individual health insurance premiums without establish a formal group health plan. For many years, this practice could result in significant penalties under theACAa.

Withal, recent changes have created specific pathways for this type of arrangement through qualified small employer health reimbursement arrangements( users ))nd individual coverage health reimbursement arrangements ( i(rChrisT)se must be officially establish and must meet specific requirements to comply with federal regulations.

False statement: group health insurance invariably provide better coverage than individual plans

While group health insurance oftentimes provide excellent coverage, it’s not universally true that group plans invariably offer better coverage than individual plans. The quality of coverage depends on:

- The specific plan select by the employer

- The employer’s contribution amount

- The individual’s healthcare need

- Available subsidies for individual market plans

Some individuals might find that plans on the individual marketplace advantageously meet their specific needs or provide more affordable coverage, especially if they qualify for premium tax credits.

Navigate group health insurance decisions

Understand the facts about group health insurance help both employers and employees make informed decisions. For employers, offer appropriate health benefits can:

- Improve recruitment and retention

- Enhance employee satisfaction and productivity

- Provide tax advantages

- Fulfill compliance obligations

For employees, understand group health insurance options enable better healthcare decisions and financial planning. Knowledge about rights, requirements, and limitations help individuals maximize their benefits while avoid unexpected costs.

Conclusion

Group health insurance represent a complex but valuable component of employee benefits packages. While most statements about these plans contain elements of truth, it’s important to distinguish fact from fiction.

The well-nigh common misconception — and the statement that’s false — is that all employers are lawfully required to offer group health insurance. This requirementappliesy exclusively to applicable large employers with 50 or mofull-timeime equivalent employees.

Other false statements include the notion that premiums are invariably base on health status, that all plans must cover identical benefits, and that employers can reimburse for individual premiums without formal arrangements.

By understand these distinctions, both employers and employees can navigate the group health insurance landscape more efficaciously, make choices that optimize coverage, compliance, and cost.

MORE FROM eboxgo.com