Devoted Health Plan Options: Complete Guide to Medicare Advantage Choices

Understand devoted health Medicare advantage plan

Devoted health offer Medicare advantage plans design to provide comprehensive healthcare coverage for Medicare eligible individuals. These plans go beyond original Medicare (parts a and b) by combine hospital insurance, medical insurance, and oftentimes prescription drug coverage into one convenient package. Devoted health distinguish itself through its commitment to member center care and technological innovation.

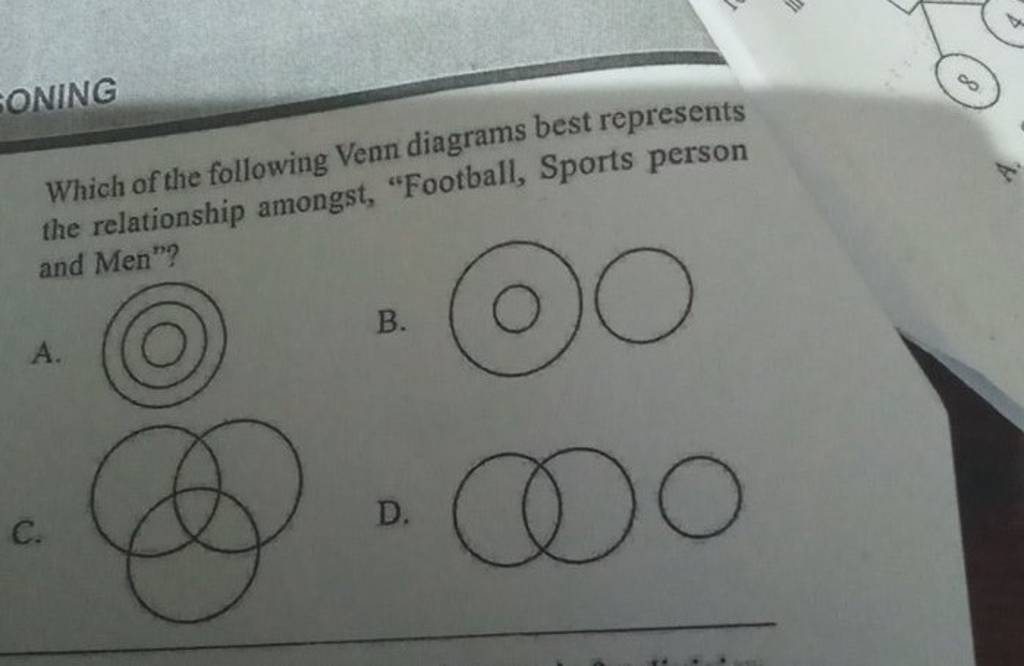

Core plan types offer by devoted health

Devoted health HMO plan

Health maintenance organization (hHMO)plan form the backbone of devoted health’s offerings. These plans require members to select a primary care physician ( (pPCP)o coordinate their healthcare and provide referrals to specialists within the network. Key features include:

- Lower monthly premiums compare to PPO plans

- Predictable copays for most services

- A define network of doctors and hospitals

- No coverage for out of network care except in emergencies

- Require referrals for specialist visits

Devoted health HMO plans typically appeal to members who prefer lower costs and don’t mind work within a define provider network.

Devoted health HMO POS plans

Some regions offer devoted health HMO point of service (hHMOpPOS)plans. These hybrid plans function mainly as hmAmosut provide limited ouout-of-networkoverage for certain services. Members tranquilize need a pcPCPo coordinate care, but gain additional flexibility when seek specific treatments.

Devoted health d SNP plans

Dual eligible special needs plans (d sSNPs)serve individuals who qualify for both meMedicarend meMedicaidThese specialized plans offer:

- Coordination between Medicare and Medicaid benefits

- Reduce or eliminate out-of-pocket costs

- Additional benefits tailor to dual eligible members

- Care coordination for complex health needs

- Specialized provider networks experience with dual eligible patients

D SNP plans help bridge gaps between Medicare and Medicaid coverage, ensure members receive comprehensive care without navigate two separate systems.

Devoted health c SNP plans

Chronic condition special need plans (c sSNPs)serve meMedicareeneficiaries with specific chronic conditions. Devoted health offer c snSNPsor conditions such as:

- Diabetes

- Cardiovascular disorders

- Chronic heart failure

- Chronic lung disorders

These plans feature specialized care management programs, provider networks with expertise in treat specific conditions, and benefits tailor to manage chronic illnesses efficaciously.

Plan benefit categories

Standard benefits across all devoted health plans

Disregardless of plan type, all devoted health Medicare advantage plans include:

- All original Medicare part a and part b benefits

- Annual wellness visits and preventive care

- Hospital inpatient coverage

- Outpatient services and procedures

- Emergency and urgent care coverage

- Lab tests and diagnostic services

- 24/7 access to telehealth services

- Access to devoted health’s care guides for personalized support

Prescription drug coverage (part d )

Most devoted health plans include prescription drug coverage (part d ) though benefit structures vary by plan level. Common prescription coverage features include:

- Tiered formulary system with different copays for generic, brand name, and specialty medications

- Mail order pharmacy options for convenient 90 day supplies

- Coverage for a wide range of medications across therapeutic categories

- Medication therapy management for members with complex medication regimens

Some plans offer reduce or $0 copays for preferred generic medications, make maintenance medications more affordable for members with chronic conditions.

Supplemental benefits

Devoted health enhance its plans with supplemental benefits that extend beyond original Medicare. These extras vary by plan but may include:

Dental coverage

Plans typically include preventive dental services like cleanings and exams. Higher tier plans may add comprehensive dental benefits cover fillings, extractions, dentures, and other restorative services.

Vision benefits

Most plans cover routine eye exams and provide allowances for glasses or contact lenses. Coverage amount range from $100 to $$500yearly depend on the specific plan.

Hear services

Hear exam coverage and allowances for hear aids are common across devoted health plans, with higher tier plans offer more generous allowances.

Over the counter (oOTC)allowance

Many plans include quarterly allowances for OTC health products, range from $25 to $$300per quarter depend on the plan level.

Fitness benefits

Devoted health typically includessilver sneakerss fitness memberships, provide access to gyms, fitness classes, and online workout programs at no additional cost.

Transportation services

Some plans offer non-emergency transportation to medical appointments, with a set number of one way trips include yearly.

Meal benefits

Follow hospital stays or for members with certain chronic conditions, plans may provide home deliver meals to support recovery and health management.

Acupuncture and alternative therapies

Select plans cover acupuncture visits and other complementary therapies beyond what original Medicare provide.

Plan tiers and metal levels

Devoted health structure its plans in tiers or metal levels that indicate benefit richness and premium costs. While specific names vary by market, they typically follow this pattern:

Devoted health essentials (basic tier )

Entry level plans with:

- Lower or $0 monthly premiums

- Higher copays and coinsurance for services

- Basic supplemental benefits

- Standard prescription drug coverage

These plans work advantageously for comparatively healthy members seek affordable coverage with predictable costs.

Devoted health core (mmid-tier)

Balanced plans feature:

- Moderate monthly premiums

- Lower copays than essentials plans

- Enhanced supplemental benefits

- More comprehensive prescription coverage

Core plans appeal to members who use healthcare services regularly and want to enhance benefits without premium costs of premium plans.

Devoted health premier (premium tier )

Comprehensive plans offer:

- Higher monthly premiums

- Lowest out-of-pocket costs for services

- Maximum supplemental benefits

- Enhanced prescription drug coverage

- Additional perks like higher allowances for vision, hearing, and OTC items

Premier plan substantially serve members with frequent healthcare needs who want comprehensive coverage and minimal out-of-pocket expenses.

Regional variations in devoted health plans

Devoted health operate in select states, and plan offerings vary importantly by region. Presently, devoted health serve members in:

- Arizona

- Florida

- Illinois

- Kentucky

- Ohio

- Pennsylvania

- Texas

Within each state, plan availability, benefits, and provider networks differ by county. Urban areas typically offer more plan options with broader networks, while rural regions may have more limited choices.

Market specific plan names

Devoted health customizes plan names by market. For example:

-

Florida plans might include” devoted health palm ” r “” voted health broward ”

” - Texas plans could feature” devoted health greater hHouston” r “” voted health north texTexas”

These regional designations reflect the specific provider networks and benefit structures tailor to local healthcare markets.

Cost structures of devoted health plans

Premium variations

Monthly premiums for devoted health plans range from $0 for many hHMOplan to over $$100for premium tier options with enhanced benefits. D snSNPlans typically have $ $0remiums for qualified dual eligible members.

Out of pocket maximums

All devoted health plans include annual out-of-pocket maximums that cap member spending on covered services. These limits typically range from:

- $3,000 to $$7550 for in network services on hmHMOlans

- Lower maximums for d SNP plans base on member income level

Once members reach these maximums, the plan covers 100 % of costs for cover services for the remainder of the calendar year.

Cost sharing structures

Devoted health use various cost sharing mechanisms:

Copayments

Fixed dollar amount for specific services, such as:

- $0 $50 for primary care visits

- $20 $75 for specialist visits

- $200 $400 per day for hospital stays ((uch with day limits ))

- $0 $95 for urgent care visits

- $50 $95 for emergency room visits ((ypically waive if admit ))

Coinsurance

Percentage base cost sharing for services like:

- 0% 20 % for durable medical equipment

- 0% 20 % for part b medications

- 0% 33 % for specialty tier prescription drugs

Deductibles

Some plans include deductibles for specific benefits:

- $0 $505 annual deductible for prescription drugs ((ary by plan and tier ))

- Most plans have $0 deductible for medical services

Devoted health’s approach to care coordination

A distinguish feature of devoted health plans is their emphasis on care coordination and member support.

Devoted health guides

All members receive access to devoted health guides — dedicated support staff who help:

- Navigate benefits and coverage questions

- Find in network providers

- Schedule appointments

- Coordinate care between different providers

- Resolve billing issues

Virtual care options

Devoted health integrate telehealth services into all plans, offering:

- 24/7 virtual urgent care

- Schedule virtual visits with primary care and specialists

- Remote monitoring for chronic conditions

- Mental health telehealth services

Care management programs

Members with complex health needs to receive additional support through:

- Chronic condition management programs

- Transition of care support after hospitalizations

- Medication management and reconciliation

- Home health coordination

- Social determinants of health assessments and interventions

How to choose the right devoted health plan

Assess healthcare need

When select a devoted health plan, consider:

- Current prescription medications and their formulary status

- Relationships with exist healthcare providers and their network participation

- Anticipated healthcare utilization base on health conditions

- Budget constraints and premium affordability

- Importance of supplemental benefits like dental, vision, and hear

Provider network considerations

Devoted health’s provider networks vary by region and plan type. Before enrolling, verify that:

Source: thetreatmentplan.substack.com

- Your preferred primary care physician participate in the network

- Specialists you see regularly are in network

- Local hospitals and urgent care facilities are cover

- Pharmacy options include convenient locations

Enrollment timing and options

Devoted health plans follow Medicare’s enrollment periods:

- Initial enrollment period when beginning eligible for Medicare

- Annual election period (oOctober15 dDecember7 )

- Medicare advantage open enrollment period (jJanuary1 mMarch31 )

- Special enrollment periods for qualify life events

Prospective members can enroll done:

Source: diahealth.net

- Devoted health’s website

- Licensed insurance agents

- Medicare.gov

- Phone enrollment with devoted health representatives

Compare devoted health to other Medicare advantage providers

Devoted health differentiate itself from competitors through:

Technology integration

Found by technology entrepreneurs, devoted health emphasize digital tools for member experience, include user-friendly apps, online portals, and digital health management tools.

Service model

The devoted health guide approach provides more personalized support than many competitors, with dedicated staff help members navigate the healthcare system.

Provider partnerships

Devoted health forms value base care partnerships with provider groups, incentivize quality over quantity in healthcare delivery.

Market focus

Unlike national carriers with presence in all states, devoted health take a deliberate approach to market expansion, focus on build strong provider relationships in select regions.

Plan limitations and considerations

Network restrictions

As mainly HMO plans, devoted health coverage loosely require members to use in network providers except in emergencies. This may limit choice compare to PPO plans from other carriers.

Geographic availability

Devoted health’s limited market presence mean many Medicare eligible individuals can not access these plans base on their residence.

Plan changes

Like all Medicare advantage plans, devoted health plans undergo annual changes to benefits, networks, and costs. Members must, will review annual notice of change documents each fall to understand how their coverage will change in the come year.

Find detailed plan information

For specific details about devoted health plans available in your area:

- Visit the devoted health website and use the plan finder tool

- Contact devoted health direct by phone

- Consult with a licensed Medicare insurance agent

- Use the Medicare plan finder on medicare.gov

- Review plan summary of benefits documents for comprehensive details

When research plans, pay special attention to the evidence of coverage document, which provide the complete contractual details of plan benefits, exclusions, and member responsibilities.

Conclusion

Devoted health offer a range of Medicare advantage plans design to meet diverse healthcare needs and budgets. From basic HMO plans with $0 premiums to comprehensive options with extensive supplemental benefits, members can find coverage align with their healthcare priorities. The company’s emphasis on care coordination, technology integration, and personalize support distinguish it in the mMedicareadvantage marketplace.

When consider devoted health plans, prospective members should cautiously evaluate their healthcare needs, provider preferences, prescription requirements, and budget constraints. By compare available options during appropriate enrollment periods, Medicare beneficiaries can select the devoted health plan that best balances coverage, cost, and convenience for their individual circumstances.

MORE FROM eboxgo.com