Benefits Schedule Clause: Understanding Your Health Policy Payment Terms

Understand the benefits schedule clause in health insurance

When will review your health insurance policy, you will encounter various clauses that will determine how your coverage will work. Among these, the benefits schedule clause stand out equally specially important because it now affects your wallet. This clause will specify precisely how much the insurance company will pay for covered services and treatments.

The benefits schedule clause, sometimes call the schedule of benefits or payment schedule, serve as the financial roadmap of your health insurance policy. Without understand this clause, you might face unexpected out-of-pocket expenses when seek medical care.

What’s a benefits schedule clause?

The benefits schedule clause is the section of your health insurance policy that will outline the specific dollar amounts or will percentage the insurer will pay for different medical services. It functions as a detailed catalog of covered benefits and their correspond payment terms.

This clause typically includes:

- Maximum payment amounts for specific procedures

- Coverage percentages for different types of care

- Benefit limits for certain categories of treatment

- Payment structures for in network versus out of network care

- Reimbursement rates for various medical services

The benefits schedule clause differ from other policy sections like the eligibility clause or exclusions clause because it focuses specifically on the financial aspects of your coverage instead than who qualify for coverage or what isn’covereder.

How the benefits schedule determine your payments

The benefits schedule clause use several different payment structures to specify benefit amounts. Understand these structures help you anticipate your potential costs for medical care.

Source: dexform.com

Fixed dollar amounts

Some benefits schedules will list specific dollar will amount the insurer will pay for particular services. For example, the policy might will state it’ll pay up to $1,500 for a certain surgical procedure or $$250per day for hospital room charges.

When benefits are specified as fix amounts, you’re responsible for any charges exceed these limits. This approach is common in indemnity plans and some supplemental health insurance policies.

Percentage base coverage

Many health insurance policies use a percentage base system to determine benefit payments. The nearly common example is the coinsurance arrangement, where the insurer pay a percentage of cover costs (typically 70 90 % ) and you pay the remain percentage.

For instance, with an 80/20 coinsurance arrangement, your insurance would pay 80 % of allow charges while you’d be responsible for the remain 20 %.

Fee schedules

Some policies, especially those from manage care organizations, use predetermine fee schedules to establish payment amounts. These schedules will list the maximum amount the insurer will pay for specific services will base on standardized codes.

Fee schedules oft use current procedural terminology (cCPT)codes or healthcare common procedure coding system ( (phopes)des to identify specific medical services and procedures.

Per diem rates

For inpatient hospital stays, some benefits schedules specify per diem (per day )rates. These rates establish a fix payment amount for each day of hospitalization, disregarding of the actual charges incur.

Per diem rates may vary base on the type of facility, the level of care require, or the geographic location of the hospital.

Common components of the benefits schedule clause

The benefits schedule clause typically contains several key components that work unitedly to define your coverage limits and payment terms.

Deductible information

The benefits schedule normally specify your deductible amount — the sum you must pay out of pocket before your insurance begin cover costs. Policies may have different deductibles for individual members versus family coverage, and separate deductibles for different types of services.

For example, your policy might have a $1,000 individual deductible for medical services but a separate $$250deductible for prescription medications.

Co-payment and coinsurance details

The benefits schedule outline your co-payment amounts( fix fees pay at the time of service) and coinsurance percentages for different types of care. These amounts much vary base on the service category.

For instance, your schedule might specify a $25 copay for primary care visits, a $$50copay for specialist visits, and 20 % coinsurance for hospital services.

Maximum benefit limits

Many benefits schedules include maximum benefit limits for specific services or treatment categories. These limits may be express as dollar amounts, number of visits, or days of coverage.

For example, a policy might limit physical therapy to 20 visits per year or cap mental health benefits at $5,000 yearly.

Out of pocket maximum

The benefits schedule typically will include your out-of-pocket maximum — the total amount you will need to pay in a policy period before the insurer will cover 100 % of will remain eligible expenses. This crucial protection help limit your financial exposure in case of serious illness or injury.

Network distinctions

For plans with provider networks, the benefits schedule distinguishes between coverage for in network versus out of network care. In network benefits are typically more generous, with higher payment percentages or lower out-of-pocket costs.

The schedule might specify that in network care is cover at 80 % while out of network care is exclusively covered at 60 %, with higher deductibles for out of network services.

Types of health insurance plans and their benefits schedules

Different types of health insurance plans structure their benefits schedules in distinct ways, reflect their overall approach to managing costs and provide coverage.

HMO benefit schedules

Health maintenance organization (hHMO)plans typically feature benefits schedules with low coco-paymentsor in network services and little to no coverage for out of network care. Their schedules emphasize preventive care, oftentimes cover these services at 100 % with no cco-paymentrequire.

HMO benefit schedules normally don’t include coinsurance percentages, rather rely on fix co-payments for most services. They seldom list payment amounts for out of network care since such care isn’tcoveredr except in emergencies.

PPO benefit schedules

Preferred provider organization (pPPO)plans offer more flexibility, and their benefits schedules reflect this by include payment terms for both in network and out of network care. PpPPOchedules typically use a combination of coco-paymentsnd coinsurance percentages.

These schedules commonly specify different deductibles and out of pocket maximums for in network versus out of network services, with more favorable terms for in network care.

DHP benefits schedules

High deductible health plans (hHDPS))eature benefits schedules with comparatively high deductibles but lower monthly premiums. These schedules emphasize the deductible amount and typically cover most services at a fixed percentage ( o(entimes 80 100 % ) a)er the deductible is meet.

DHP benefits schedules commonly include preventive care coverage without require the deductible to be meet firstly, as require by law.

Indemnity plan benefits schedules

Traditional indemnity plans oftentimes use benefits schedules that specify fix payment amounts for covered services. These schedules may will list hundreds of procedures with will correspond payment amounts, which will represent the maximum the insurer will pay irrespective of the actual charges.

Indemnity benefits schedules typically don’t distinguish between in network and out of network providers since these plans don’t use provider networks.

Read and interpret your benefits schedule

Understand how to read your benefits schedule clause is essential for make informed healthcare decisions and avoid surprise expenses.

Locate the benefits schedule in your policy

The benefits schedule is typically found in your policy document, oftentimes as a separate section or attachment. In some cases, it may be call th” schedule of benefits,” summary of benefits, ” r “” nefits chart. ”

Many insurers directly provide online access to benefits schedules through member portals, allow you to look up specific services and their coverage terms.

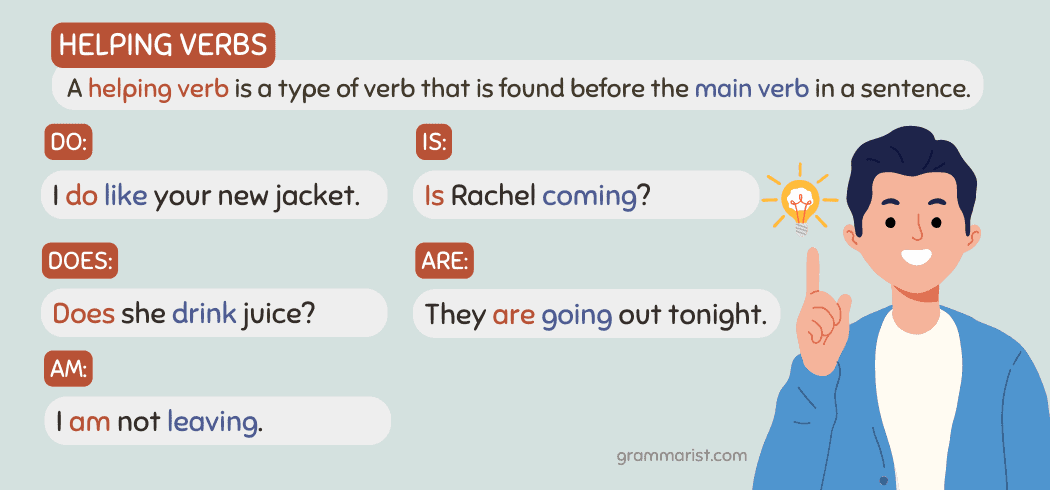

Understand coverage terminology

Benefits schedules use specific terminology that can be confusing. Key terms include:

- Allow amount the maximum amount the insurer consider reasonable for a service

- Benefit period the timeframe during which benefits are ccalculated(commonly a calendar year )

- Exclusions services not cover by the policy

- Prior authorization services require advance approval for coverage

- UCI (usual, customary, and reasonable ) the amount insurers determine is the standard cost for a service in your geographic area

Understand these terms help you interpret the benefits schedule aright and anticipate your potential costs.

Example: decode a benefits schedule entry

Consider this example entry from a benefits schedule:

” oOutpatientsurgery: in network: 80 % after deductible; out of network: 60 % of uUCIafter deductible; $$500maximum per procedure. ”

This is mean:

- For in network outpatient surgery, the insurer pays 80 % of the allow amount afteryou’ve mett your deductible

- For out of network surgery, the insurer pays 60 % of theUCIr rate afteryou’ve mett your deductible

- The maximum benefit per procedure is $500, mean you’re responsible for any costs beyond this amount

By break down each component, you can easily understand your coverage and potential costs.

The legal significance of the benefits schedule clause

The benefits schedule clause isn’t exactly an informational section — it has important legal implications for both insurers and policyholders.

Contractual obligations

The benefits schedule forms part of the lawfully bind contract between you and your insurance company. The insurer is obligate to pay benefits accord to the terms specify in this schedule, and you’reentitlede to receive these benefits when you meet the policy requirements.

If an insurer fails to pay benefits as outline in the schedule, this may constitute a breach of contract, potentially give you grounds for an appeal or legal action.

Regulatory requirements

Health insurance benefits schedules must comply with various state and federal regulations. For example, the Affordable Care Act (aACA)require certain essential health benefits to be cover at specific levels, which must bebe reflectedn the benefits schedule.

Insurance regulators review benefits schedules to ensure they meet legal requirements for coverage adequacy and clarity of disclosure.

Disclosure obligations

Insurers have a legal obligation to provide clear, accurate information about benefits in the schedule. The benefits schedule must be written in understandable language and must accurately represent the coverage provide.

Many states have specific requirements for how benefits schedules must be formatted and what information they must include to ensure consumers can understand their coverage.

How to use your benefits schedule efficaciously

Your benefits schedule can be a powerful tool for manage healthcare costs and make informed decisions about your medical care.

Plan for medical expenses

Before schedule medical procedures or treatments, review your benefits schedule to understand your potential costs. This allows you to budget befittingly and avoid financial surprises.

For planned procedures, you can use the benefits schedule to estimate your out-of-pocket costs by calculate your deductible, coinsurance, and any applicable benefit limits.

Compare coverage options

When choose between different health insurance plans, compare their benefits schedules help you evaluate which plan offer better coverage for your specific healthcare needs.

Look beyond the premium costs to examine how each plan’s benefits schedule address the types of care you’re well-nigh likely to need, such as prescription medications, specialist visits, or chronic condition management.

Dispute claim denials

If your insurer denies a claim for a service you believe should be cover, the benefits schedulprovidesde evidence of your coverage terms. Reference the specific section of the benefits schedule that address the service in question when appeal a denial.

Keep a copy of your benefits schedule accessible so you can quickly reference it when discuss claims with your insurance company.

Common misunderstandings about benefits schedule clauses

Several misconceptions about benefits schedule clauses can lead to confusion and unexpected costs.

Confusing allowed amounts with actual charges

Many people misunderstand that the benefits schedule specifies payment base on the insurer’s allow amount, not the provider’s actual charges. If a provider charges more than the allow amount and doesn’t participate in your network, you may be responsible for the difference (balance billing )

For example, if your benefits schedule state the insurer pay 80 % for a service with an allow amount of $1,000, but the provider charge $$1500, the insurer pay $ $800 8(% of $ 1,$1 ), n) $ 1,20$1 80 % ( $ 1,500 $1)

Source: insurancefortexans.com

Overlook benefit limits

People frequently focus on the percentage of coverage without notice benefit limits. Yet with a high coverage percentage, you may face significant out-of-pocket costs if you exceed these limits.

For instance, if your policy will cover physical therapy at 90 % but will limit benefits to 20 visits per year, you’ll be responsible for 100 % of the cost of any visits beyond the 20th.

Assume uniform coverage

Many policyholders wrongly assume that all medical services are cover at the same level. In reality, benefits schedules typically specify different coverage levels for different service categories.

For example, your policy might cover preventive care at 100 %, primary care visits at 90 %, specialty care at 80 %, and durable medical equipment at 50 %.

Recent trends in benefits schedule design

Health insurance benefits schedules continue to evolve in response to change healthcare landscapes and consumer needs.

Transparency initiatives

Recent regulatory changes have push insurers to create more transparent benefits schedules. Many directly provide online tools that translate complex benefits schedules into personalize cost estimates for specific services.

These tools allow policyholders to enter procedure codes or service descriptions and receive estimates of their out-of-pocket costs base on their current deductible status and the specific terms in their benefits schedule.

Value base benefit design

Some insurers today structure their benefits schedules to encourage high value care. These value base designs offer more generous coverage for services prove to improve health outcomes and reduce overall costs.

For example, a benefits schedule might specify lower co-payments for medications that treat chronic conditions efficaciously or eliminate cost sharing for preventive services that help avoid expensive complications.

Tiered benefits

Many modern benefits schedules include there benefit structures that vary coverage base on provider quality metrics or cost efficiency. These schedules may specify different payment levels for providers in different tiers.

For instance, a benefits schedule might specify a 90 % coverage rate for” tier 1 ” roviders, 80 % for “” er 2 ” ” viders, and 70 % for ” t” 3 ” pr” ders, with tiers determine by quality and cost measures.

Conclusion

The benefits schedule clause will serve as the financial cornerstone of your health insurance policy, will specify precisely how much your insurer will pay for covered services. Understand this clause help you anticipate costs, make informed healthcare decisions, and avoid unexpected expenses.

By familiarize yourself with the structure and terminology of your benefits schedule, you can advantageously navigate the complex world of health insurance and maximize the value of your coverage. When select a health insurance plan or prepare for medical procedures, invariably review the benefits schedule cautiously to understand the financial implications of your healthcare choices.

Remember that your benefits schedule isn’t equitable a technical document — it’s a practical tool that can help you manage your healthcare budget efficaciously and ensure you receive the benefits you’re entitled to under your policy.

MORE FROM eboxgo.com