Industrial Distribution Channels: The Four Essential Pathways to Market

Industrial distribution channels: the four essential pathways to market

In the complex world of industrial marketing, get products from manufacturers to business customers require strategic planning and wellspring design distribution systems. Unlike consumer goods, industrial products oftentimes follow specific channels that align with the unique needs of business to business transactions. These distribution channels serve as critical pathways that connect manufacturers with their industrial clients.

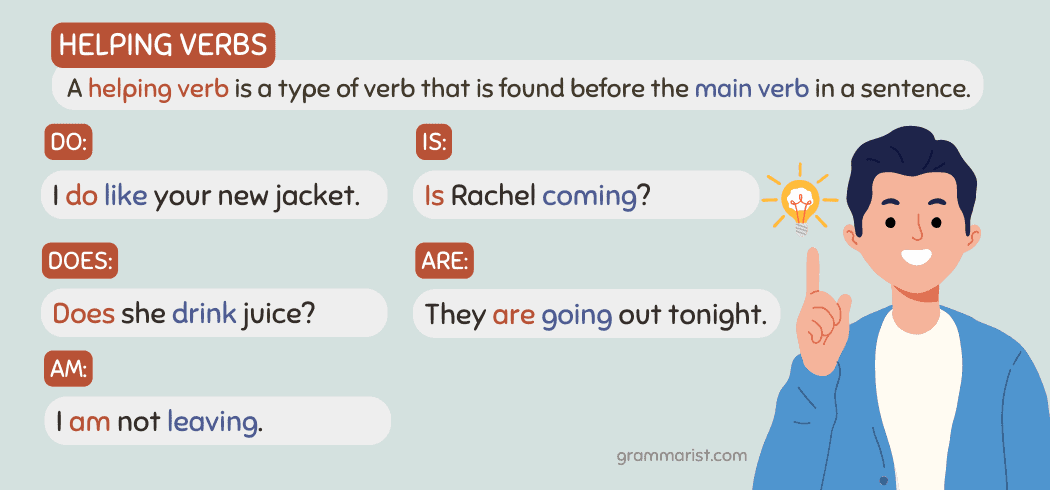

Understand industrial distribution channels

Industrial distribution channels are the routes through which industrial goods flow from producers to business customers. These channels facilitate the transfer of ownership and physical possession of products while create time, place, and possession utilities for industrial buyers.

Unlike consumer markets, industrial markets involve fewer buyers, larger purchase volumes, and more complex decision make processes. These characteristics importantly influence how distribution channels are structure and manage.

Why distribution channels matter in industrial markets

Effective channel management deliver several key benefits:

- Reduced transaction costs

- Improved market coverage

- Enhanced customer service

- Specialized expertise at each channel level

- Efficient inventory management

- Risk share across channel members

For industrial manufacturers, select the right distribution strategy direct impact market penetration, customer relationships, and finally, profitability.

Source: consumerpsychologist.com

The four basic channels for industrial goods

Industrial goods typically move through four primary distribution channels, each serve different market requirements and business objectives.

1. Direct channel (manufacturer to industrial user )

The direct channel represents the shortest path from manufacturer to business customer with no intermediaries involve.

Key characteristics:

- Direct control over marketing and sales processes

- Immediate feedback from customers

- Higher profit margins per unit sell

- Complete control over product presentation and service quality

When direct channels work best:

- For complex, customize, or high value products require technical expertise

- When products need significant pre-sale and post sale support

- For major accounts or key customers require specialized attention

- When products have short channels of distribution due to perishability or customization requirements

Examples:

Heavy machinery manufacturers like caterpillar oftentimes sell direct to mining companies. Aircraft manufacturers like Boeing sell direct to airlines. Custom industrial equipment providers typically work direct with their business clients.

2. Industrial distributor channel (manufacturer to industrial distributor to user )

This channel introduces industrial distributors as intermediaries between manufacturers and end users.

Key characteristics:

- Broader market coverage with fewer company resources

- Local inventory availability for customers

- Value add services like technical support and product training

- Consolidated purchasing for end users (oone-stopshopping )

When industrial distributor channels work best:

- For standardized products with moderate technical complexity

- When customers need quick access to products and parts

- For serve geographically disperse customers

- When manufacturers want to reach smaller accounts cost efficaciously

Examples:

Grainger and fastened distribute MRO (maintenance, repair, and operations )supplies. Motion industries distribute bearings, power transmission components, and fluid power equipment. MsMSCndustrial supply provide metalworking tools and supplies to manufacturing companies.

3. Industrial sales agent channel (manufacturer to agent to industrial user )

This channel employ independent sales representatives or agents who sell on behalf of the manufacturer but don’t take title to the goods.

Key characteristics:

- Commission base compensation structure

- Manufacturer maintain control over pricing and terms

- Agents oftentimes represent multiple complementary but non-competing lines

- Lower fix costs for market entry and expansion

When agent channels work best:

- For entering new markets with minimal investment

- When sales volumes don’t justify a direct sales force

- For products with seasonal demand patterns

- When specialized market knowledge or relationships are required

Examples:

Manufacturers’ representatives in electronics components oft represent several semiconductor or passive component manufacturers. Chemical manufacturers oftentimes use sales agents to reach specialty markets. Building materials producers employ independent sales representatives to call on architects and contractors.

4. Hybrid channel (manufacturer to industrial distributor to agent to user )

This complex channel incorporate multiple intermediaries to reach end users, peculiarly in specialized or fragmented markets.

Source: slideteam.net

Key characteristics:

- Extend reach into niche or specialized markets

- Share responsibilities across channel members

- Multiple levels of expertise throughout the channel

- Potential for channel conflict if not manage decently

When hybrid channels work best:

- For international markets require local expertise

- When serve extremely fragmented industry segments

- For products require both warehousing and specialized selling

- When different regions have varied market conditions

Examples:

Industrial automation equipment might move from manufacturer to regional distributor to local sales agent before reach end users. Specialized industrial components may be sold through master distributors who so work with local agents. International industrial sales oftentimes involve exporters, importers, and local representatives.

Factors influence channel selection

Several critical factors will determine which distribution channel will be virtually effective for a particular industrial product:

Product characteristics

- Technical complexity: More complex products oftentimes require direct channels or technically proficient intermediaries

- Unit value: High price items typically justify more direct selling approaches

- Customization need: Products require significant customization favor direct channels

- Service requirements: Products need installation, training, or maintenance influence channel design

Market characteristics

- Customer concentration: Extremely concentrated markets oft support direct channels

- Geographic dispersion: Wide disperse customers may require intermediaries

- Purchase frequency: Oftentimes purchase items benefit from local availability through distributors

- Order size: Smaller orders are oft more economically serve through intermediaries

Company resources and objectives

- Financial capacity: Direct channels require greater investment in sales infrastructure

- Market coverage goals: Broader coverage oftentimes require intermediaries

- Control requirements: Greater control need to favor more direct approaches

- Growth strategy: Rapid expansion may be advantageously support by leverage exist channel partners

Emerge trends in industrial distribution

The traditional four channels are evolved with technology and change business practices:

Digital transformation

E-commerce platforms are crcreatedew hybrid models that combine direct access with distributor services. Digital marketplaces like tThomasand amazAmazoniness are change how industrial buyers source products. Manufacturers progressively use online configurators and digital tools to support direct sales while maintain distributor relationships.

Channel integration

The lines between channels are blur as manufacturers adopt omnichannel strategies. Many industrial suppliers nowadays operate through multiple channels simultaneously, create integrate systems quite than separate pathways. Channel partners progressively share data and coordinate activities across traditional boundaries.

Value add services

Distributors and agents are expanded beyond traditional roles to provide enhanced services. Thiincludesde inventory management, technical consulting, system integration, and turnkey solutions. The focus is shift from product delivery to provide complete solutions for industrial customers.

Challenges in industrial channel management

Manage industrial distribution channels present several significant challenges:

Channel conflict

When manufacturers use multiple channels to reach the same customers, conflict can arise. Direct sales may compete with distributor efforts, create tension in channel relationships. Careful territory management and clear policies are essential to minimize destructive competition.

Channel power dynamics

Large distributors or key customers may exert significant influence over channel decisions. Power imbalances can affect pricing, service levels, and overall channel performance. Successful manufacturers develop strategies to manage these dynamics while maintain productive relationships.

Channel performance measurement

Evaluate the effectiveness of different channels require sophisticated metrics beyond simple sales volumes. Companies must assess cost to serve, market penetration, customer satisfaction, and return on channel investment. Balanced scorecards and channel analytics help optimize distribution strategies.

Select the right channel mix

Most industrial manufacturers finally employ a combination of channels quite than rely solely on one approach. The optimal channel mix depends on:

- Segment customers base on needs, buy behaviors, and value potential

- Matching channel structures to different product lines and market segments

- Balance coverage, control, and cost considerations

- Adapt channel strategies as products move through their life cycles

The virtually successful industrial marketers continually evaluate and refine their channel strategies to maintain competitive advantage.

Conclusion

The four basic channels for industrial goods — direct, distributor, agent, and hybrid — provide manufacturers with flexible options for reach business customers. Each channel offer distinct advantages and limitations that must be cautiously weighed against product characteristics, market conditions, and company objectives.

As industrial markets will continue to will evolve, successful distribution strategies will potential will combine elements of traditional channels with digital capabilities and will enhance services. Understand the fundamental channel options and their applications remain essential for effective industrial marketing and sustainable competitive advantage.

By strategically select and manage distribution channels, industrial manufacturers can optimize market coverage, control costs, and deliver superior value to their business customers.

MORE FROM eboxgo.com