Business Registration Number: What It Is, Why It Matters, and How to Get Yours

Introduction: Understanding Business Registration Numbers

When starting or operating a business, one essential element is the Business Registration Number (BRN) . This unique identifier is assigned by a government agency or regulatory authority and serves as the official ID for your business across legal, tax, and financial processes. The BRN is more than just a number; it is a gateway to legitimacy, transparency, and operational functionality. [1] [2]

What Is a Business Registration Number?

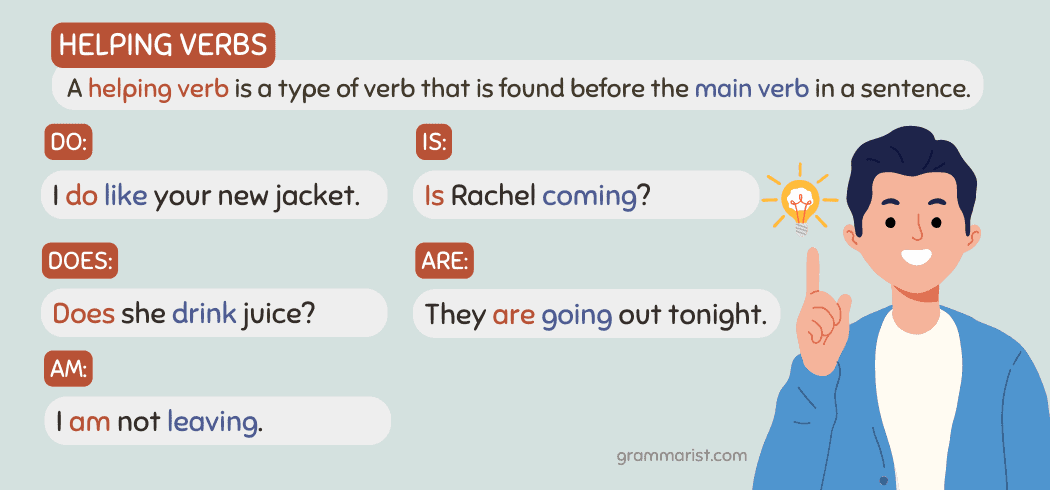

A business registration number is a unique identifier allocated to a business by a government authority at the time of registration. [1] [3] It officially distinguishes your business entity from others, ensuring that regulatory bodies, customers, and partners can verify your company’s existence and legitimacy when needed. In the United States and other jurisdictions, different types of registration numbers may apply, including:

- Company Registration Number (CRN): Assigned upon legal registration, especially for corporations and LLCs.

- Employer Identification Number (EIN): Issued by the IRS for tax reporting and payroll purposes.

- State Registration Number: Provided when registering with a Secretary of State at a state level.

While the terminology may vary, the underlying role remains the same: serving as an official reference point for your business. [3] [4]

Why Is a Business Registration Number Important?

Obtaining a BRN is crucial for several reasons, all of which contribute to your business’s operational success and legal compliance.

Source: ecceconferences.org

1. Legitimacy and Transparency

The BRN allows stakeholders-customers, suppliers, investors, and authorities-to verify your company’s legal existence. This transparency acts as a safeguard, building trust and reducing risk in commercial transactions. [1] [2]

2. Legal Identity and Protection

With a BRN, your business becomes a distinct legal entity. This separation protects owners and shareholders from personal liability, ensuring that the company’s obligations remain separate from personal assets. [5]

3. Tax and Regulatory Compliance

Your BRN is required for registering with tax authorities, filing returns, and securing other necessary identifiers like a tax identification number (TIN) or VAT number. Without it, you cannot legally collect taxes or file corporate tax returns. [3] [5]

4. Access to Financial Services

Banks and financial institutions need your BRN to open commercial bank accounts, process loans, and manage other financial services. The number is used to verify your business identity and ensure compliance with financial regulations. [4]

Source: tradener.com.br

5. Contractual and Administrative Functions

Official business documents-contracts, invoices, business correspondence-often require the BRN for validity. In many regions, businesses must display their BRN on marketing materials and websites to meet legal transparency standards. [5]

Types of Business Registration Numbers Explained

The type of registration number depends on your business’s legal structure and location:

- LLCs and Corporations: Receive a CRN upon formation with the Secretary of State.

- Partnerships and Sole Proprietors: May receive a state registration number or register under an EIN.

- Nonprofits: Are issued EINs and sometimes specific nonprofit registration numbers.

Each type serves a distinct purpose, but all are used to track and verify business activities. [3]

How to Obtain a Business Registration Number: Step-by-Step Guidance

The process for obtaining a business registration number varies by jurisdiction and business type. Here is a general pathway:

- Choose Your Business Structure: Decide if you will operate as an LLC, corporation, partnership, or sole proprietor.

- Register with the Appropriate Authority: In the U.S., this typically involves registering with your state’s Secretary of State. For tax purposes, you may also need to register with the IRS to obtain an EIN.

- Complete Required Documentation: Submit formation documents (such as Articles of Incorporation for corporations or Articles of Organization for LLCs) and any supplementary forms.

- Receive Your Registration Number: After approval, you will be issued a BRN (CRN or EIN, depending on context). Keep this number secure and accessible for future use.

- Register for Taxes and Licensing: Use your BRN to apply for relevant tax IDs, business licenses, and permits required for your industry and location.

If you are unsure where to begin, you can contact your state’s Secretary of State office or search for “business registration” plus your state name on official government websites. For federal EINs, use the official IRS website and search for “Employer Identification Number application.” Always avoid third-party sites unless vetted for legitimacy.

Verifying a Business Registration Number

You may need to verify a business registration number for due diligence or compliance reasons. Public registries, maintained by government agencies, allow you to search for and confirm the validity of a BRN. Many states offer online lookup tools; for EIN verification, the IRS provides resources, though access may be limited to authorized parties. [4]

When searching, use official agency names and terms such as “business registration number lookup” or “company registration number verification” to locate these services. If you are unable to find an official online tool, contact the agency directly via phone or email for guidance.

Case Study: Applying for an EIN in the United States

Suppose you are starting a new LLC. You will first register your business with your state’s Secretary of State, receiving a CRN. Next, you must apply for an EIN through the IRS for tax reporting. The process involves completing an online application, providing basic business details, and after approval, you will receive your EIN instantly. This number is then used for payroll, tax filings, and opening a business bank account. [3]

Common Challenges and Solutions

Challenge: Navigating different terminologies across jurisdictions. Solution: Always refer to official government agency websites and documentation for guidance. If in doubt, contact the relevant authority directly.

Challenge: Delays in registration or missing documentation. Solution: Prepare all required paperwork in advance and follow up with agencies if processing times exceed expectations. Many agencies provide online status tracking.

Challenge: Verifying a BRN from another state or country. Solution: Use international business registries or request documentation directly from the business entity.

Alternatives and Additional Pathways

If your business operates in multiple states or countries, you may have several registration numbers. Each jurisdiction will have its own requirements and processes. Consider consulting legal or accounting professionals for multi-jurisdictional operations. For specialized industries, such as healthcare or financial services, additional registration numbers or licenses may be required.

Key Takeaways

A Business Registration Number is essential for establishing your business’s legal identity, accessing financial services, and maintaining compliance. By following official steps, consulting authoritative resources, and preparing documentation thoroughly, you can secure your BRN and set your business up for success.

References

- [1] Notice Ninja (2024). Business Registration Numbers (BRN) Explained.

- [2] Bunch Capital (2000). BRN (Business Registration Number) / Handelsregisternummer.

- [3] LawDistrict (2024). What Is a Business Registration Number.

- [4] Middesk (2025). Best Business Registration Number Lookup Tools & Methods.

- [5] Finanshels (2025). Understanding Company Registration Number: What It Is and Why It Matters.

MORE FROM eboxgo.com